Overview of Trade Finance

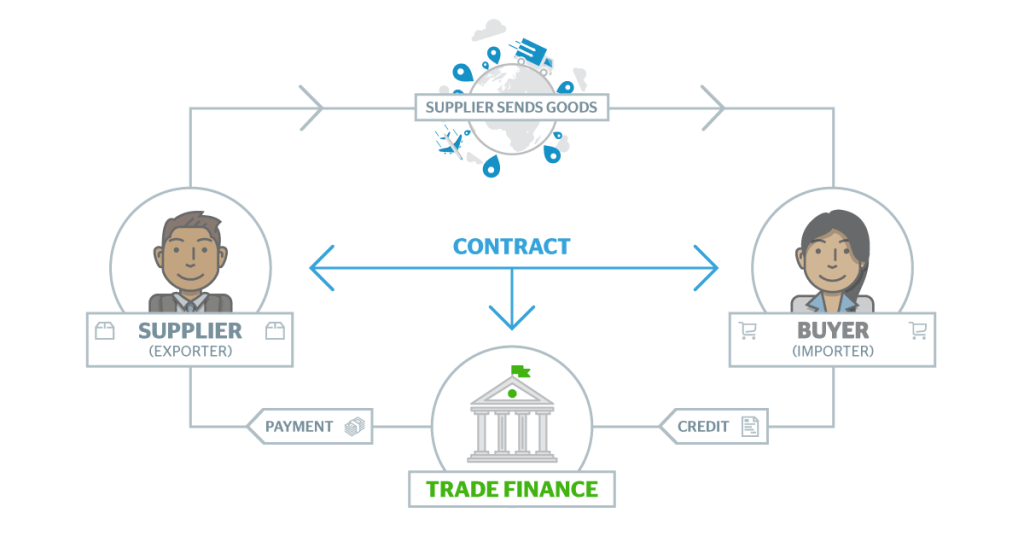

Trade finance in Dubai encompasses a range of financial products and services that facilitate international trade and commerce. At Wolf Street Group, we understand that the world of trade is complex, involving multiple parties, various risks, and significant capital requirements. Trade finance is the lifeline that helps businesses mitigate risks, secure payments, and ensure the smooth movement of goods and services across borders.

Trade finance includes instruments such as letters of credit, bills of exchange, and trade credit insurance, each designed to support different aspects of trade transactions. It not only provides financial support but also offers risk mitigation solutions, ensuring that exporters receive payment and importers get the goods as agreed.

Dubai as a Hub for Trade Finance

Dubai’s strategic geographic location at the crossroads of Europe, Asia, and Africa has made it a pivotal hub for global trade. The city’s world-class infrastructure, modern logistics capabilities, and business-friendly environment create an ideal ecosystem for trade and finance. With its rapidly growing economy, political stability, and progressive regulatory frameworks, Dubai has become a major center for trade finance activities.

At Wolf Street Group, we leverage Dubai’s unique position to provide comprehensive trade finance solutions that cater to the needs of businesses looking to expand their global reach. The city’s dynamic economy and innovative trade policies make it an attractive destination for both investors and businesses engaged in international trade.

Key Players in Dubai’s Trade Finance Sector

Dubai’s trade finance ecosystem is robust and diverse, with a multitude of stakeholders contributing to its success. Key players include:

- Government Bodies: Agencies such as Dubai Customs and the Dubai Department of Economic Development play crucial roles in regulating and facilitating trade.

- Financial Institutions: Banks like Emirates NBD, Dubai Islamic Bank, and international giants like HSBC and Standard Chartered provide extensive trade finance services.

- Trade Organizations: Entities like the Dubai Chamber of Commerce and Industry and Dubai Exports support trade activities by offering resources and advocacy for businesses.

At Wolf Street Group, we work closely with these entities to ensure that our clients have access to the best trade finance solutions available in Dubai.

Types of Trade Finance Instruments

Letters of Credit (LCs)

Letters of credit are essential tools in trade finance, providing a secure method of payment that mitigates the risks associated with international trade transactions.

Overview

An LC is a commitment from a bank on behalf of the buyer that guarantees payment to the seller upon the presentation of specified documents. It ensures that the exporter will be paid once they meet the terms and conditions agreed upon in the LC.

Benefits for Importers and Exporters

For importers, LCs offer assurance that the payment will be made only if the goods are shipped as per the agreed terms. For exporters, LCs guarantee that they will receive payment from a reputable bank, reducing the risk of non-payment. At Wolf Street Group, we help businesses navigate the complexities of LCs to secure their international transactions effectively.

Bills of Exchange

Bills of exchange are widely used in trade finance as instruments that facilitate payment and provide a legal obligation for the buyer to pay the seller a specific amount on a set date.

Definition and Use

A bill of exchange is a written, unconditional order by one party (the drawer) directing another party (the drawee) to pay a specified amount to a third party (the payee) or the bearer of the bill.

Benefits and Drawbacks

The main advantage of using bills of exchange is that they provide a clear, legally enforceable document that facilitates international payments. However, they can be complex to manage and may involve delays if disputes arise. Wolf Street Group assists clients in understanding and utilizing bills of exchange to streamline their trade finance processes.

Trade Credit Insurance

Trade credit insurance is a critical tool for managing the risk of non-payment in trade transactions, providing coverage against commercial and political risks that could lead to non-payment by buyers.

Purpose and Function

Trade credit insurance protects exporters from the risk of non-payment due to buyer insolvency, political instability, or other risks. It enables businesses to extend credit to buyers with confidence, knowing they are protected against potential losses.

Major Providers in Dubai

In Dubai, major providers of trade credit insurance include international insurers like Euler Hermes and Coface, as well as local providers. Wolf Street Group partners with these insurers to offer tailored trade credit insurance solutions that meet the specific needs of our clients.

Documentary Collections

Documentary collections involve the handling of trade documents by banks, ensuring that payment is made by the importer before the documents needed to take possession of the goods are released.

Mechanism and Benefits

In documentary collections, the exporter’s bank sends the shipping documents to the importer’s bank, which holds them until payment is made or a bill of exchange is accepted. This method provides a secure way to manage payment and delivery of goods, reducing the risks for both parties.

Factoring and Forfaiting

Factoring and forfaiting are financial services that help businesses manage cash flow and mitigate risks associated with international trade.

Comparison and Benefits

- Factoring: Involves the sale of accounts receivable to a third party (the factor) at a discount. This provides immediate cash flow and reduces the risk of non-payment.

- Forfaiting: Similar to factoring but involves the sale of long-term receivables by an exporter to a forfaiter who assumes all risks. Forfaiting is typically used for large, capital-intensive transactions.

Wolf Street Group offers both factoring and forfaiting services, helping clients improve their liquidity and reduce the risks associated with international trade.

Export and Import Financing

Export and import financing includes various financial products designed to support the movement of goods across international borders.

Key Aspects and Providers

Export and import financing can involve pre-shipment finance, which provides working capital for the production of goods, and post-shipment finance, which provides funding once goods have been shipped. Major providers in Dubai include local and international banks offering a range of financing solutions tailored to the needs of businesses. Wolf Street Group specializes in providing customized export and import financing solutions to support our clients’ international trade operations.

Importance of Trade Finance in Dubai

Facilitating International Trade

Dubai’s strategic location and well-developed infrastructure make it a vital hub for global trade. Trade finance plays a crucial role in facilitating the flow of goods and services by providing the necessary financial support and risk management tools. At Wolf Street Group, we understand the importance of efficient trade finance solutions in enabling businesses to engage in international trade with confidence.

Enhancing Economic Growth

Trade finance significantly contributes to Dubai’s economic growth by enabling businesses to expand their markets and operations. It supports the development of key industries, creates employment opportunities, and drives innovation. The robust trade finance infrastructure in Dubai is a testament to the city’s commitment to fostering a thriving, diversified economy.

Supporting SMEs

Small and medium-sized enterprises (SMEs) are the backbone of Dubai’s economy, and access to trade finance is critical for their growth and success. Wolf Street Group is dedicated to providing SMEs with the financial tools and resources they need to compete in the global marketplace. Our trade finance solutions help SMEs manage risks, improve cash flow, and expand their international reach.

The Regulatory Framework in Dubai

Overview of Trade Finance Regulations

Dubai’s trade finance sector is governed by a comprehensive regulatory framework designed to ensure transparency, security, and compliance. Key regulatory bodies include the Dubai Financial Services Authority (DFSA), which oversees financial institutions and ensures adherence to international standards.

Dubai Financial Services Authority (DFSA)

The DFSA is responsible for regulating financial services in the Dubai International Financial Centre (DIFC). It ensures that trade finance activities are conducted in a secure and compliant manner, protecting the interests of all parties involved. At Wolf Street Group, we work closely with the DFSA to ensure our services comply with all regulatory requirements.

Trade Laws and Compliance

Dubai’s trade laws provide a solid legal foundation for trade finance activities. Key laws include the UAE Commercial Transactions Law, which governs trade and commerce, and the UAE Central Bank regulations, which oversee financial transactions. Compliance with these laws is essential for businesses to operate effectively in the trade finance sector. Wolf Street Group provides expert guidance to help clients navigate the complex regulatory landscape.

International Trade Agreements

Dubai is a signatory to numerous international trade agreements that facilitate trade by reducing tariffs, eliminating trade barriers, and promoting economic cooperation. These agreements enhance Dubai’s position as a leading hub for global trade. Wolf Street Group leverages these agreements to provide clients with advantageous trade finance solutions that maximize their international trade opportunities.

Trends and Innovations in Trade Finance

Digitalization of Trade Finance

The digitalization of trade finance is transforming the way businesses conduct international trade. Digital platforms and technologies such as blockchain are streamlining trade finance processes, reducing paperwork, and enhancing security.

Role of Technology

Technology is revolutionizing trade finance by enabling real-time tracking of transactions, automating documentation, and improving transparency. At Wolf Street Group, we incorporate the latest digital solutions to provide our clients with efficient, secure, and cost-effective trade finance services.

Digital Platforms and Solutions

Digital platforms offer integrated trade finance solutions that simplify the management of trade transactions. These platforms enable businesses to access a range of services, including digital letters of credit, online trade documentation, and real-time payment tracking. Wolf Street Group partners with leading digital platforms to provide clients with seamless trade finance experiences.

Blockchain and Trade Finance

Blockchain technology is emerging as a powerful tool in trade finance, offering secure, transparent, and immutable transaction records.

Applications and Benefits

Blockchain can significantly reduce the time and costs associated with trade finance by providing a secure, decentralized ledger for recording transactions. It enhances transparency, reduces the risk of fraud, and simplifies the verification of trade documents. Wolf Street Group is exploring blockchain applications to offer innovative trade finance solutions that meet the evolving needs of our clients.

Trade Finance and Sustainability

Sustainable trade finance is gaining traction as businesses increasingly focus on environmental, social, and governance (ESG) criteria.

Green Finance Initiatives

Green finance initiatives promote environmentally sustainable projects and practices. In trade finance, this includes providing funding for eco-friendly projects and encouraging sustainable trade practices. Wolf Street Group is committed to supporting green finance initiatives that contribute to a more sustainable global economy.

Environmental Impact and Regulations

Environmental regulations are becoming more stringent, and businesses must comply with these requirements to secure trade finance. Wolf Street Group helps clients navigate the complexities of environmental regulations and offers solutions that promote sustainable trade practices.

Emerging Trends

The trade finance landscape is continually evolving, with new trends and innovations shaping the industry.

Fintech Innovations

Fintech companies are driving innovation in trade finance by introducing new technologies and business models that enhance efficiency and reduce costs. These include digital trade platforms, alternative financing options, and data analytics tools. Wolf Street Group stays at the forefront of these innovations to provide our clients with cutting-edge trade finance solutions.

New Trade Finance Models

New models of trade finance are emerging to meet the changing needs of businesses. These include supply chain finance, which optimizes working capital for both buyers and suppliers, and trade finance marketplaces, which connect businesses with a wide range of financing options. Wolf Street Group offers these innovative trade finance models to help clients achieve their business goals.

Challenges and Opportunities in Trade Finance

Common Challenges

Despite the many benefits of trade finance, businesses face several challenges, including regulatory complexity and financial risks.

Regulatory Complexity

Navigating the complex regulatory environment can be challenging for businesses engaged in international trade. Compliance with local and international regulations is essential to avoid legal issues and penalties. Wolf Street Group provides expert guidance to help clients manage regulatory compliance and mitigate risks.

Financial Risks

Trade finance involves various financial risks, including credit risk, currency risk, and political risk. These risks can impact the profitability and success of trade transactions. Wolf Street Group offers comprehensive risk management solutions to help clients mitigate these risks and ensure the smooth execution of their trade transactions.

Opportunities in Trade Finance

The trade finance sector presents numerous opportunities for growth and investment.

Growth Sectors

Key growth sectors in trade finance include technology, renewable energy, and healthcare. These sectors offer significant potential for expansion and investment. Wolf Street Group identifies and supports clients in capitalizing on these growth opportunities through tailored trade finance solutions.

Investment Opportunities

Trade finance offers attractive investment opportunities for businesses and investors looking to diversify their portfolios. Investment options include trade finance funds, structured trade finance products, and direct investments in trade finance projects. Wolf Street Group provides expert advice and access to a range of investment opportunities in the trade finance sector.

Case Studies of Trade Finance in Dubai

Successful Trade Finance Projects

At Wolf Street Group, we have a track record of successful trade finance projects that demonstrate our expertise and commitment to client success.

Overview and Impact

One notable project involved providing trade finance solutions for a major construction company in Dubai, enabling them to secure the necessary funding for a large-scale infrastructure project. Our solutions helped the company manage their cash flow, mitigate risks, and ensure timely completion of the project.

Lessons Learned from Challenges

Our experience in trade finance has taught us valuable lessons that we apply to improve our services continually.

Analysis and Recommendations

A key challenge we encountered was managing the complex regulatory requirements for a cross-border trade transaction. By working closely with regulatory bodies and leveraging our expertise, we successfully navigated the complexities and provided our client with a compliant, efficient trade finance solution. We recommend that businesses engage with experienced trade finance providers like Wolf Street Group to navigate regulatory challenges effectively.

Expert Insights on Trade Finance

Interviews with Industry Leaders

We have gathered insights from leading experts in the trade finance industry to provide our clients with valuable perspectives.

Key Insights and Perspectives

Industry leaders emphasize the importance of digitalization, risk management, and sustainable trade practices in the future of trade finance. They highlight the need for businesses to adopt innovative technologies and comply with evolving regulations to remain competitive in the global market. Wolf Street Group incorporates these insights into our trade finance services to provide clients with forward-thinking solutions.

Future of Trade Finance in Dubai

The future of trade finance in Dubai is bright, with numerous opportunities for growth and innovation.

Predictions and Trends

Experts predict that digitalization, sustainability, and fintech innovations will continue to drive the evolution of trade finance. As businesses increasingly focus on environmental and social responsibility, sustainable trade finance solutions will become more important. Wolf Street Group is committed to staying at the forefront of these trends and providing our clients with cutting-edge trade finance solutions.

Frequently Asked Questions (FAQs)

What is Trade Finance and How Does It Work?

Trade finance encompasses a range of financial instruments and products that facilitate international trade by mitigating risks and providing financial support. It helps businesses manage the complexities of cross-border transactions by offering solutions such as letters of credit, bills of exchange, and trade credit insurance.

Why is Dubai a Leading Hub for Trade Finance?

Dubai’s strategic location, world-class infrastructure, and business-friendly environment make it a leading hub for trade finance. The city’s robust regulatory framework, progressive economic policies, and strong support for international trade attract businesses and investors from around the world.

What are the Common Trade Finance Instruments Used in Dubai?

Common trade finance instruments in Dubai include letters of credit, bills of exchange, trade credit insurance, documentary collections, factoring, and forfaiting. These instruments provide businesses with the financial support and risk management solutions needed to conduct international trade efficiently.

How Does Digitalization Impact Trade Finance?

Digitalization is transforming trade finance by streamlining processes, reducing paperwork, and enhancing security. Digital platforms and technologies such as blockchain provide real-time tracking, automation, and transparency, making trade finance more efficient and cost-effective.

What are the Key Regulations Affecting Trade Finance in Dubai?

Key regulations affecting trade finance in Dubai include the UAE Commercial Transactions Law, UAE Central Bank regulations, and international trade agreements. Compliance with these regulations is essential for businesses to operate effectively in the trade finance sector.

Conclusion

Summary of Key Points

Trade finance is a critical component of international trade, providing the financial support and risk management solutions needed to facilitate the movement of goods and services across borders. Dubai’s strategic location, robust infrastructure, and supportive regulatory environment make it an ideal hub for trade finance activities.

The Future of Trade Finance in Dubai

The future of trade finance in Dubai is promising, with numerous opportunities for growth and innovation. Digitalization, sustainability, and fintech innovations will continue to shape the industry, providing businesses with new tools and solutions to manage their trade transactions effectively.

Contact Wolf Street Group Dubai Now

At Wolf Street Group, we are dedicated to providing our clients with comprehensive trade finance solutions that meet their unique needs.

Contact us today to learn more about how we can support your international trade activities and help you navigate the complexities of the global trade finance landscape.